Companies incorporated in Malaysia. Historical corporate tax rate data.

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Advance Pricing Arrangement.

. Income Tax Rates and Thresholds Annual Tax Rate. Resident individuals Chargeable income RM YA 20182019 Tax RM on excess 5000 0 1 20000 150 3 35000 600 8 50000 1800. Chargeable Income RM Calculations RM Rate Tax RM 0 5000.

Malaysia - Corporate Tax Rate. Income Tax Rates and Thresholds Annual Tax Rate. Malaysia Non-Residents Income Tax Tables in 2019.

Mutual Agreement Procedure MAP Multilateral Instrument MLI Non-Resident. In Budget 2017 it is suggested that decrease of expense rate for increment in chargeable wage will apply for YA. 20182019 Malaysian Tax Booklet 22 Rates of tax 1.

For both resident and non-resident companies corporate income tax CIT is imposed on income accruing in or derived from Malaysia. For example lets say your annual taxable income is RM48000. Rate TaxRM A.

The carryback of losses is not permitted. On the First 5000 Next 15000. With our Malaysia corporate income tax calculator you will be able to get quick tax calculation adjustments that help you to estimate and accurately forecast your tax payable amounts.

The current CIT rates are provided in the following table. KPMGs corporate tax rates table provides a view of corporate tax rates around the world. Here are the income tax rates for personal income tax in Malaysia for YA 2019.

0 tax rate for 10 or 15 years for new companies that invest a minimum of MYR 300 million or MYR 500 million respectively in the manufacturing sector in Malaysia. Indirect tax rates individual income tax. On the first 5000.

Reduction of corporate tax rate for small medium enterprises SMEs on chargeable income of up to RM 500000 to 17 from 18 effective from YA 2019. Corporate companies are taxed at the rate of 24. On the First 5000.

Rate The standard corporate tax rate is 24 while the rate for resident small and medium-sized companies ie. Cukai Makmur will be imposed on companies excluding companies which enjoy the 17 reduced tax rate above. Positioning Corporate Malaysia for a sustainable future.

Country Default Spreads and Risk Premiums. Data is also available for. Malaysian Tax Issues for Expats - activpayroll OECD Tax Database - OECD Taiwan Corporate Tax Rate 2021.

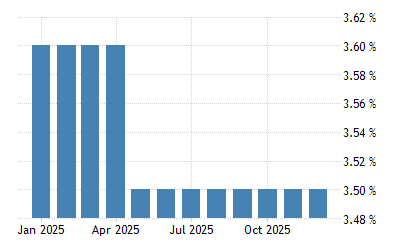

Knoema an Eldridge business is the premier. Trading Economics provides data for 20 million economic indicators from 196 countries including actual values consensus figures. Malaysia Corporate Tax Rate was 24 in 2022.

Malaysia Non-Residents Income Tax Tables in 2019. Based on this amount the income tax to pay the government is RM1640 at a rate of 8. With paid-up capital of 25 million Malaysian ringgit MYR or less and.

Why It Matters In Paying Taxes Doing Business World Bank Group

Gst In Malaysia Will It Return After Being Abolished In 2018

Malaysia Five Takeaways From The New Oecd Economic Survey Ecoscope

Malaysia Economic Performance First Quarter 2019home Statistics By Themes National Accounts Malaysia Economic Performance Malaysia Forced Labor Economy

Individual Income Tax In Malaysia For Expatriates

Why It Matters In Paying Taxes Doing Business World Bank Group

Malaysia Five Takeaways From The New Oecd Economic Survey Ecoscope

Malaysia Share Of Economic Sectors In The Gross Domestic Product 2020 Statista

Doing Business In The United States Federal Tax Issues Pwc

How Much Does A Small Business Pay In Taxes

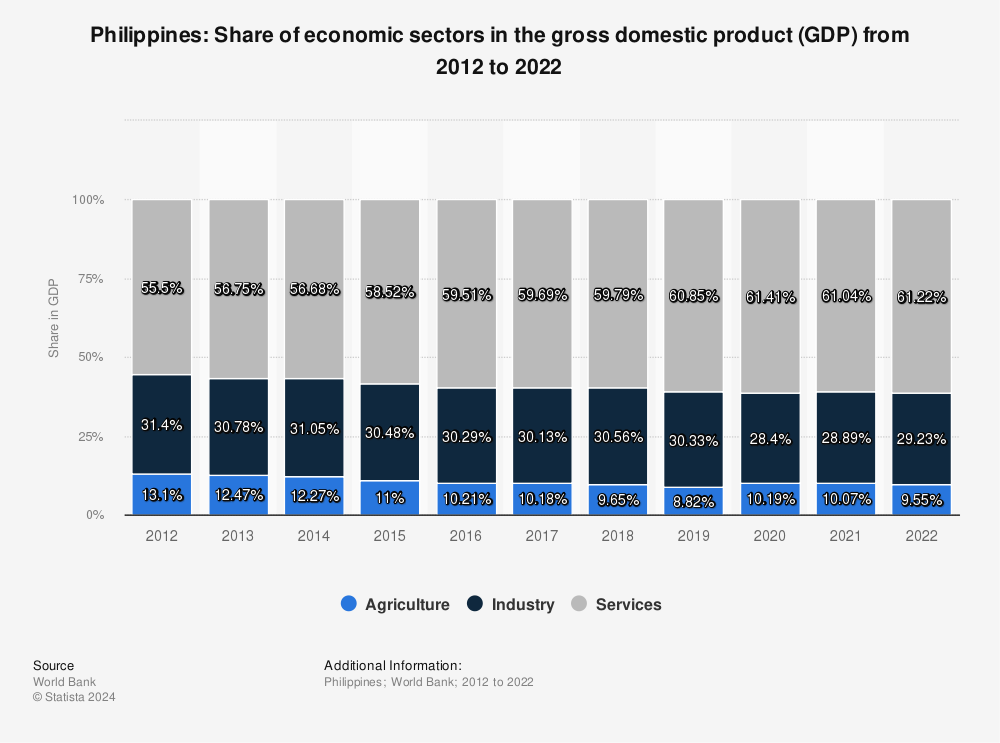

Philippines Share Of Economic Sectors In The Gross Domestic Product 2020 Statista

Malaysia Five Takeaways From The New Oecd Economic Survey Ecoscope

21 Tax Reliefs Malaysians Can Get Their Money Back For This 2019 World Of Buzz Relief Tax Money

Browse Our Sample Of Dividend Payment Voucher Template Dividend Templates Voucher

10 Things To Know For Filing Income Tax In 2019 Mypf My